Are you in Davidson County, and recently received a letter in the mail from the Property Assessor? Here’s the reason your taxes could go up.

1. Nashville property values have skyrocketed

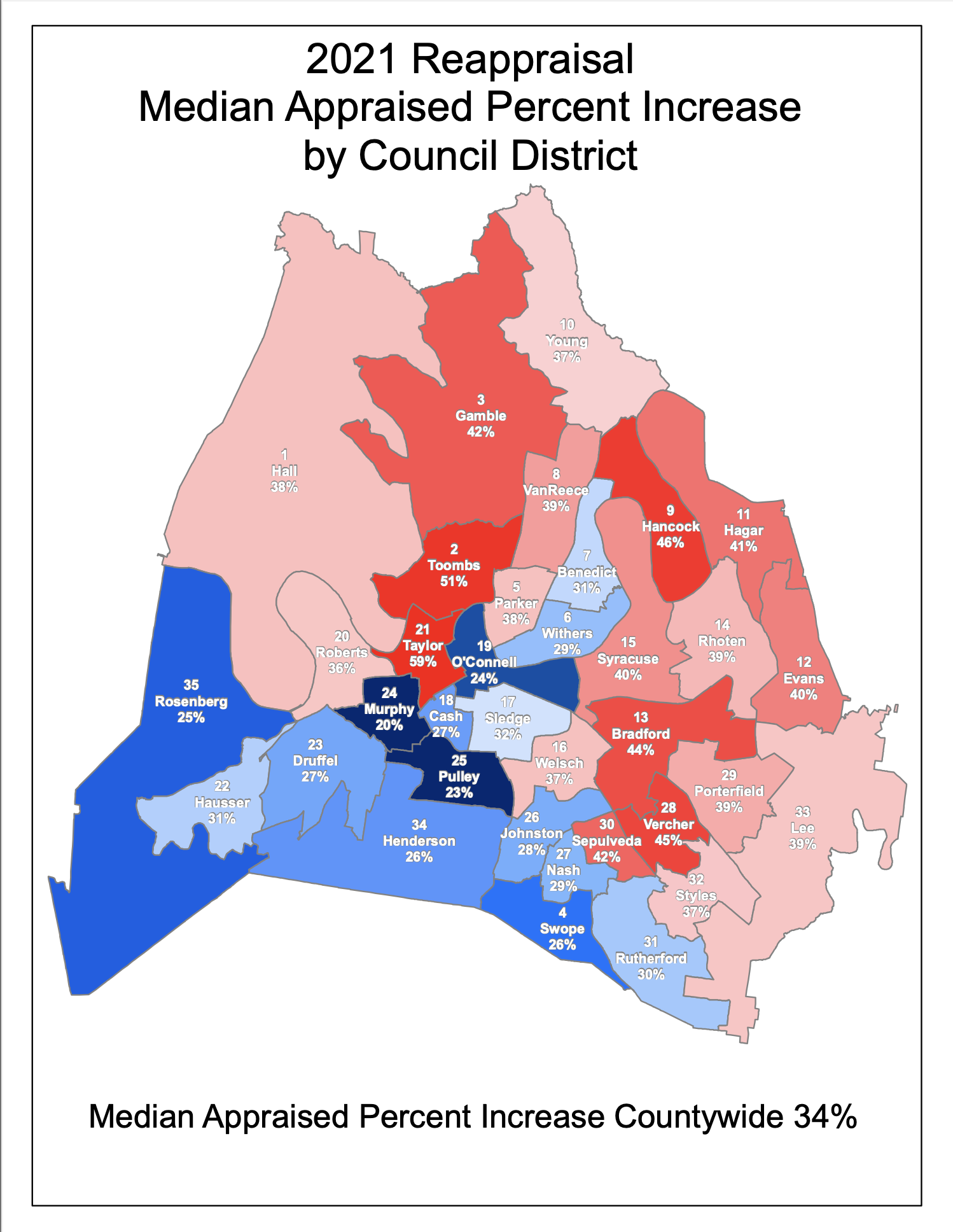

If you are a homeowner in Davidson County, you recently received a letter in the mail from the Property Assessor. These letters were mailed last week and contain the results of your new appraisal value for your real estate property or properties (“total appraised value”). This number is more than likely an increase from the notice you received four years ago during the last reassessment. While the county-wide median value increase is 34%, some areas in Nashville experienced as high as 90% increase in value of real estate. This number is down from the 37% increase in 2017 This map of Davidson County shows the percent increases you will likely see reflected on your new appraisal for your home in Davidson County.

2. You’re in an affected council district

So what does this mean for your property TAXES? Well, the amount of your property taxes are determined using the following:

- the Davidson County property tax (%)

- the total appraised value of the property ($)

- the assessment ratio (25% for residential)

- the total assessed value of the property ($)

Therefore, if the property tax were to stay the same in 2021 as it was in 2020 ($3.788 for most areas in Nashville) residents would see a pretty noticeable increase in the amount of property taxes they owe next year. For example, a residential home located in council district 21 likely experienced a 59% increase in total appraised value of the property. In 2020, this homeowner would have paid roughly $2,638 in property taxes. However, in 2021, this same homeowner would likely pay $2,931 in property taxes at the same tax rate.

We do not yet know what the property tax rate will be, as this number is determined by local government. The Davidson County Property Assessor believes the tax rate will decrease as a result of this reassessment. An update will come to this blog as more information becomes available, including the announced 2021 tax rate.

If you do not agree with the new assessment value of your property in Davidson County, there is an opportunity to apply for a review of the value. Our office of real estate lawyers can help with that,

Keep reading

→ Property Assessor of Nashville and Davidson County

→ Filing an appeal with the Property Assessor’s Office

MORE BLOGS

→ BLOG: What you need to know about Drone Regulations

→ BLOG: Tennessee Real Estate Disclosures